Maximizing Benefits with Capital One Venture X Authorized User: A Comprehensive Guide

Introduction

The Capital One Venture X card is known for its excellent travel rewards and benefits. Adding an authorized user to your account can further enhance these perks. Whether you’re looking to maximize points, streamline travel expenses, or enjoy exclusive benefits, this guide will walk you through everything you need to know about adding an authorized user to your Capital One Venture X card.

The Capital One Venture X Card

The Capital One Venture X card is a premium travel rewards credit card offering substantial benefits to frequent travelers. It provides unlimited 2X miles on every purchase, a generous sign-up bonus, and a variety of travel-related perks. Cardholders can enjoy access to airport lounges, travel credits, and no foreign transaction fees, making it a favorite among travel enthusiasts.

What is an Authorized User?

An authorized user is someone who is added to a primary cardholder’s credit card account, allowing them to make purchases and enjoy some of the card’s benefits. The primary cardholder remains responsible for all charges made by the authorized user. This arrangement can be beneficial for families, couples, or business partners looking to consolidate expenses and maximize rewards.

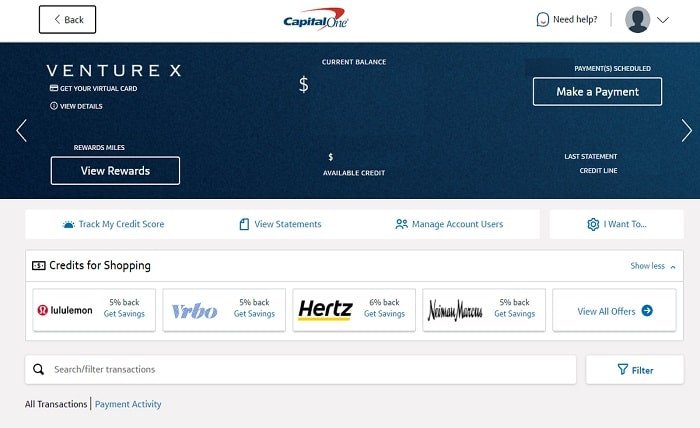

How to Add an Authorized User

Adding an authorized user to your Capital One Venture X card is a straightforward process. You can do this through your online account or by calling customer service. You’ll need to provide the authorized user’s personal information, including their name, date of birth, and Social Security number. Once added, the authorized user will receive their own card linked to your account.

Benefits of Adding an Authorized User

Adding an authorized user to your Capital One Venture X card comes with several benefits:

- Increased Reward Earnings: With more spending on the card, you accumulate rewards faster.

- Shared Benefits: Authorized users can enjoy travel perks like lounge access and travel credits.

- Expense Management: Consolidate family or business expenses into one account for easier management.

- Credit Building: Responsible use can help authorized users build their credit history.

Managing Spending and Payments

Managing spending and payments with an authorized user requires clear communication and setting spending limits if necessary. Primary cardholders can monitor all transactions through their online account and should regularly review statements to ensure all charges are accurate. It’s important to establish guidelines with authorized users to avoid overspending and ensure timely payments.

Impact on Credit Scores

Adding an authorized user can impact both the primary cardholder’s and the authorized user’s credit scores. Positive payment history and low credit utilization can benefit both parties. However, missed payments or high balances can negatively affect credit scores. It’s crucial for both the primary cardholder and the authorized user to understand the responsibility involved.

Maximizing Rewards with an Authorized User

To maximize rewards, coordinate spending strategies with your authorized user. Focus on categories that earn the most points and ensure all travel-related expenses are charged to the card. Utilizing bonus categories and taking advantage of promotional offers can significantly boost your reward earnings.

Travel Benefits for Authorized Users

Authorized users on the Capital One Venture X card can enjoy several travel benefits:

- Lounge Access: Authorized users can access Capital One Lounges and partner lounges.

- Travel Credits: They can utilize travel credits for booking flights, hotels, and other travel-related expenses.

- No Foreign Transaction Fees: Authorized users can make international purchases without incurring extra fees.

Security and Fraud Protection

Capital One provides robust security and fraud protection for all cardholders, including authorized users. Primary cardholders can set up account alerts, monitor transactions, and report suspicious activity. In case of unauthorized charges, both the primary cardholder and authorized user are protected by Capital One’s zero liability policy.

Potential Drawbacks to Consider

While there are many benefits to adding an authorized user, there are potential drawbacks:

- Shared Liability: The primary cardholder is responsible for all charges made by the authorized user.

- Credit Impact: Mismanagement of the account can negatively affect both parties’ credit scores.

- Potential for Overspending: Without clear communication, authorized users might overspend, leading to higher balances and interest charges.

Removing an Authorized User

If you need to remove an authorized user from your account, the process is simple. You can do this through your online account or by contacting customer service. Removing an authorized user will stop their ability to make new purchases, but they remain responsible for any charges made before their removal.

Conclusion

Adding an authorized user to your Capital One Venture X card can be a great way to maximize benefits, streamline expenses, and enjoy enhanced travel perks. However, it’s essential to manage the account responsibly and communicate clearly with authorized users. By understanding the process and potential impacts, you can make the most of this feature.

FAQs

1. How do I add an authorized user to my Capital One Venture X card? Adding an authorized user can be done online or by calling customer service. You will need to provide personal information for the authorized user.

2. What are the benefits of adding an authorized user? Benefits include increased reward earnings, shared travel perks, consolidated expenses, and potential credit building for the authorized user.

3. Can an authorized user access airport lounges? Yes, authorized users can enjoy lounge access along with other travel benefits provided by the Capital One Venture X card.

4. Will adding an authorized user affect my credit score? Yes, the activity on the card can impact both the primary cardholder’s and the authorized user’s credit scores, positively or negatively.

5. How can I remove an authorized user from my account? You can remove an authorized user through your online account or by contacting Capital One customer service.